In this article series, we will analyze data obtained from our PitStop sessions conducted so far to share industry-based corporate professionals' perspectives on technology, their priority areas, and details of their investment plans. We will see that each industry has its own unique needs and digital transformation strategies.

Automotive Industry: Leading the Digital Transformation

For our initial analysis, we examine the automotive industry. 205 professionals from 51 different corporate firms within this dynamic sector took part in our sessions. To ensure objective results without influencing participants' decisions, we provided no prior guidance; instead, we presented technology companies' areas of expertise and value propositions objectively, allowing corporate professionals to make independent assessments.

Departmental Participation Breakdown

The highest participation rates came from Information Technology (17.5%), Human Resources (15.1%), Production (9.3%), Marketing (6.8%), and Innovation (6.3%) departments respectively.

Whilst the IT department's dominance was expected, the significant participation from HR is particularly striking. This demonstrates that within the automotive sector, digital transformation is viewed as critical not merely for technical infrastructure, but equally for human capital management.

So what technologies is the automotive sector focusing on?

Future Investment Plans vs. Current Usage: Clear Messages

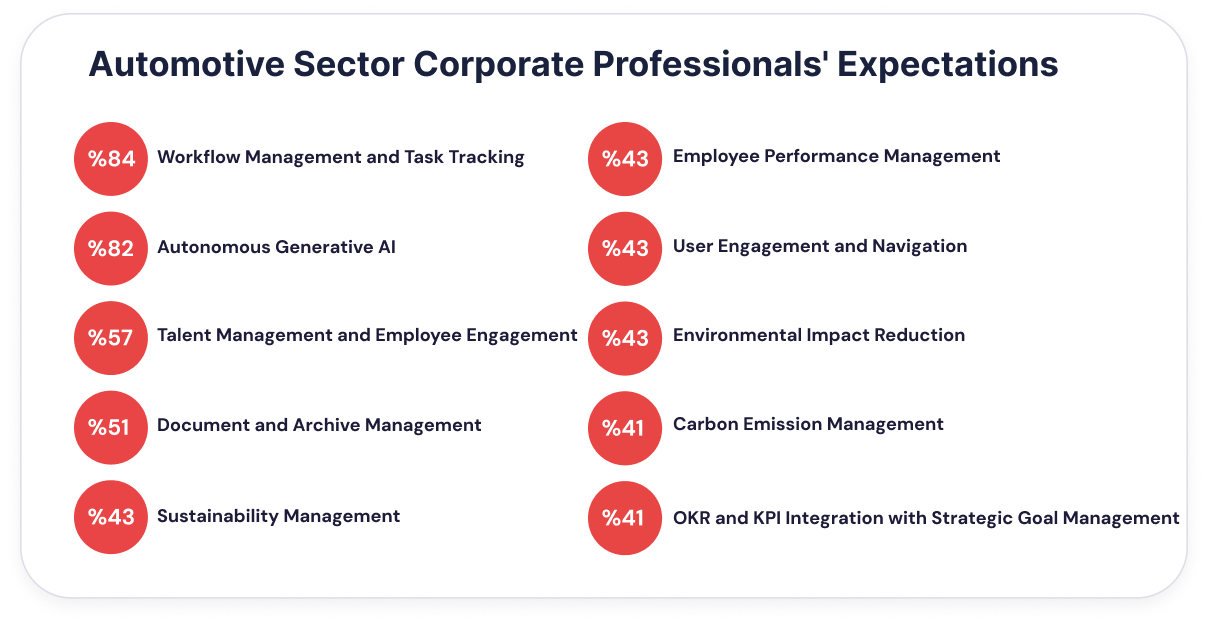

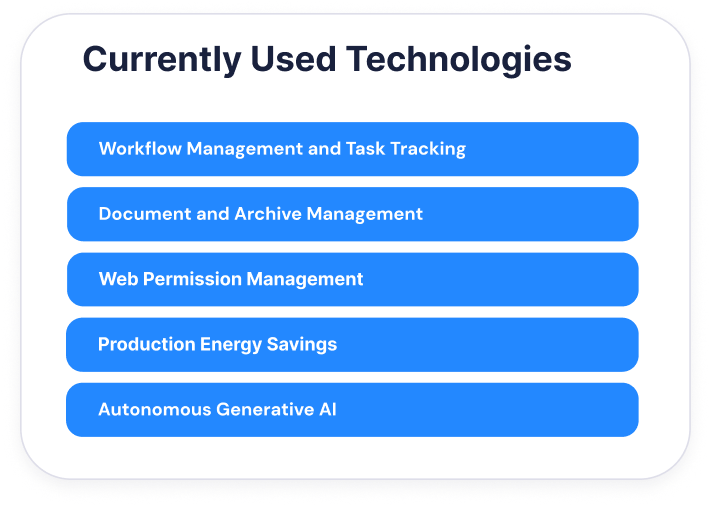

Our comparison between participants' future investment plans and current technology usage revealed striking findings. "Workflow Management and Task Tracking" alongside "Autonomous Generative AI" emerged prominently in both current usage and future investment plans.

This indicates that existing solutions are proving inadequate or there's a strong need for replacement/upgrading. Companies are inclined to enhance the technologies they currently use in these areas or replace them with more comprehensive solutions.

Furthermore, there's a markedly high appetite for investing in Human Resources-focused technologies. In total, 3 areas from current usage also feature in future investment plans - this signals that technology requirements within the automotive sector are gaining clarity.

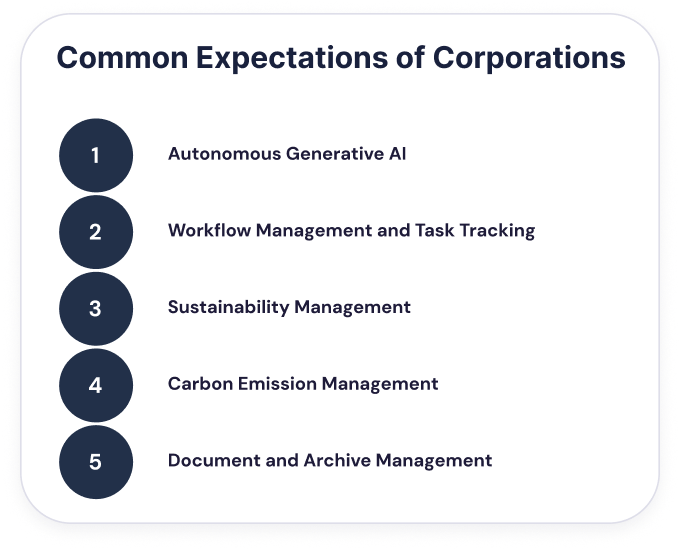

Cross-Sector Common Trends: Universal Needs

In our analysis covering all industries, we've identified shared expectations across 3 or more sectors. These common areas point to significant opportunity zones for technology providers.

A notable finding: Despite these shared need areas featuring in 2025 investment plans, participants' interest levels are lower than expected. This paradox suggests that whilst companies recognize their need for these technologies, they have yet to finalize their timing and ROI calculations, and are most likely still in the evaluation phase.

Conclusions and Recommendations

The automotive industry's technology investment trends demonstrate how seriously the sector is approaching digital transformation. Particularly, the active participation of IT and HR departments reveals that technological innovations are being evaluated from both operational and human resources perspectives.

In our next article, we'll share findings from the Finance sector. How different are finance professionals' technology priorities from automotive? Don't forget to follow us to catch all analyses in this series.

Discussion