While technology continues to rapidly transform the finance sector, how are corporations prioritizing their digital investments? We conducted an extensive research study to answer this question by examining technology preferences among finance industry decision-makers.

Research Methodology: Objective Data Collection Process

Through our comprehensive PitStop event series, we analyzed technology preferences from 120 corporate professionals across 30 financial institutions. We employed an objective presentation methodology to ensure unbiased participant responses and independent evaluations.

Finance Sector Analysis: Departments Leading Tech Innovation

The distribution of departments seeking technology solutions in the finance sector revealed highly meaningful results:

Leading Departments in Technology Search:

- 🚀 Innovation Team (33%) - Digital transformation leaders of the sector

- 📈 Marketing (24%) - Customer experience-focused technology search

- 💻 Information Technology (16%) - Infrastructure and system modernization

- 👥 Human Resources (13%) - Operational efficiency objectives

- 🎯 C-level (12%) - Strategic technology decisions

This breakdown shows that innovation-centric approaches are the driving force behind technology investments in finance. Rising cybersecurity threats over recent years have been a major factor pushing these investment decisions forward.

So, Which Technologies is the Financial Sector Focusing On?

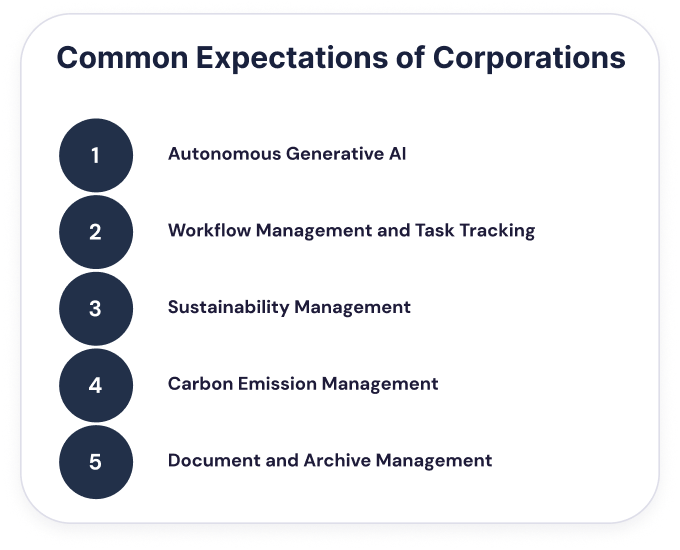

Future Investment Plans vs. Current Usage: Clear Signals

An analysis of the financial sector's technology investment strategies reveals striking findings when comparing current usage to future plans. According to our data, there are significant parallels between the technologies currently in use by corporate professionals in the financial sector and their future investment priorities.

Most Anticipated Technology Areas in the Finance Sector

1. Artificial Intelligence and Machine Learning: The Heart of Financial Transformation

According to our data, artificial intelligence and machine learning technologies hold a critical position in both current usage and future investment plans of finance sector corporate professionals.

Comparison of current usage and future investment plans:

- Advanced Identity Authentication and Risk Management (78%) - Leading area in both current usage and future plans

- Payment Infrastructure and Integrations (91%) - Highest expectation level

2. Digital Transformation and Open Banking: The Rise of Fintech Technologies

In our research data, digital transformation and open banking areas hold significant positions in both current usage and future investment plans of finance sector professionals.

Leading current usage areas:

- Dynamic Portfolio Management (56%)

- Financial Trading, Ethical Risk Analysis and Reporting (59%)

- Information, Document and Archive Management (53%)

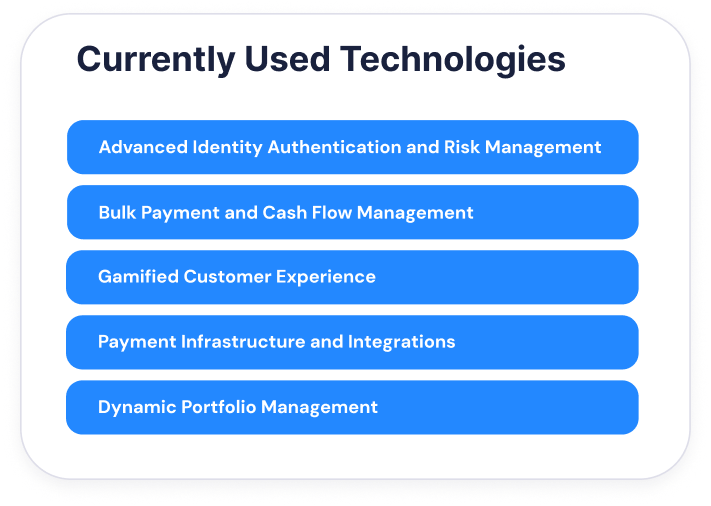

Current Technology Usage: Which Areas Are Already Active?

According to our research findings, the following technologies stand out in the finance sector's current usage areas:

- Advanced Identity Authentication and Risk Management - 78%

From fingerprint scanning at ATMs to facial recognition in mobile banking - the 78% security technology investment is actually the systems we use in our daily lives.

- Bulk Payment and Cash Flow Management

- Gamified Customer Experience

- Payment Infrastructure and Integrations - 91%

In those 2 seconds when you tap your card on the terminal, payment infrastructure technologies with 91% investment backing are activated behind the scenes.

- Dynamic Portfolio Management - 56%

This data shows that "Advanced Identity Authentication and Risk Management" and "Payment Infrastructure and Integrations" areas stand out in both current usage and future investment plans.

Finance and Artificial Intelligence: Building the Future Today

From customer services to fraud detection, from credit risk assessments to payment processes, artificial intelligence (AI) has been triggering significant changes in the FinTech sector for many years, opening doors to new approaches every day.

AI-Focused Financial Services

In 2025, financial technology companies are expected to invest more heavily in AI-based security solutions such as real-time fraud detection, behavioral analysis, and biometric authentication. The instant SMS alert you receive when using your card in a different city at midnight is a daily reflection of these technologies.

Finance Sector Digital Transformation Strategies: Conclusions and Recommendations

Our research findings show that technology investment strategies in the finance sector are highly consistent. The fact that most of the technologies currently in use are also included in future investment plans indicates that the sector's strategic technology vision is becoming clearer.

Key findings:

- Intense interest in artificial intelligence and automation technologies

- Focus on payment technologies and digital wallet solutions

- Continuous investment in risk management and security technologies

- Growth in customer experience and gamification areas

This data shows that the finance sector adopts a 'technology for customer experience' approach rather than 'technology for technology's sake'. The finance sector is expected to make significant breakthroughs in AI-powered payment systems, security solutions, and customer-centric digital banking.

What Do These Data Mean for Your Company?

Our research findings reveal technology investment trends in the finance sector. So where does your company stand in this technology transformation?

Evaluate yourself:

- Is your current technology infrastructure above the 78% security standard?

- Do your investments in AI and payment technologies meet sector averages?

- Which technologies do you plan to focus on in the next 2 years?

The answers to these questions will determine your company's position in the digital transformation journey. If you're seeking sector-based perspectives while shaping your technology strategy, you can discover the most innovative solutions in the sector by participating in PitStop events and exchange ideas about your technology investment strategies.

Discussion